The big $15.7 billion acquisition in the Analytics world

Published by: Pritee Verma

World’s #1 analytics platform got acquired by #1 CRM company.

After a long weekend vacation to Blue mountains, this historic news injected much more energy into me than my large full cream, two spoonful’s of sugar-loaded cappuccino does in the mornings.

Tying of Titans: Need for Customer Analytics and Intelligence accentuated:

Tableau, a start-up in a bedroom that went on to become a billion-dollar company was acquired by Salesforce, a CRM giant for an enterprise value of $15.7 billion on Monday,10th June 2019.

Tableau helps people visualise and understand data.

On the other hand, Salesforce helps people engage and understand customers. Customer Analytics!

Tableau and Salesforce, both have been consistent proven leaders in the field of analytics and CRM, respectively. Both share a similar vision, similar culture and similar revolutionary start-up story.

Most of my clients have Tableau. And among them many have Salesforce. I had seen a resonance and used to wonder. They were competing for the same end result – “End Customer Liberation” through different directions. Joining hands makes sense!

So,

What it means to my clients?

What new business terrains it ushers us into?

What’s the takeaway for the data analytics community?

Tableau Story:

Tableau, founded in 2003, disrupted the big market of traditional Business Intelligence and Data Analytics. It revolutionised the world of data analysis by taking the business of Business Intelligence and Data Analytics from secluded IT teams to business users, offering first of its kind accessibility because of its no programming features, intuitiveness, ease of implementation.

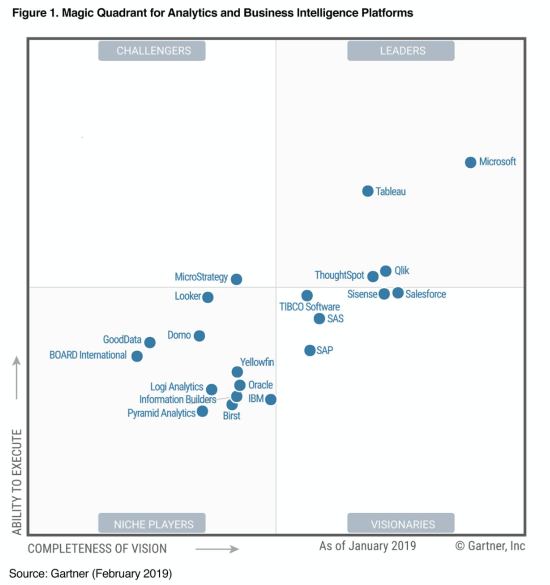

It has managed to remain a leader in Gartner Magic quadrant for seven consecutive years. Gartner,[13]

Gartner conducts a Market analysis that rates the provider on completeness of the solution and ability to execute.

Its unparalleled visualisation features forced established players such as Microsoft, Oracle and others to roll up their sleeves and release newer versions matching the visualisation capability of Tableau.

Salesforce Saga:

Salesforce had an equivalent or perhaps more interesting revolutionary start-up story. It successfully disrupted the market of incumbent, on-premise software providers with a model no one had heard of before, Cloud Computing.

In the late 1990s, competition between big enterprise companies, like Oracle and SAP, was compelling companies to add more and more features and offerings to their CRM products, making them bulky, complex and expensive.

Salesforce came into being, that was simpler and easier to use than the bulky products that were available. It was quick to set up, integrated easily with existing systems, easy to pay for per user, and always ran faster.

It sought huge popularity and was named one of Forbes’s “World’s Most Innovative Company” eight years in a row and #1 on the FORTUNE ‘100 Best Companies to Work For®’ List.

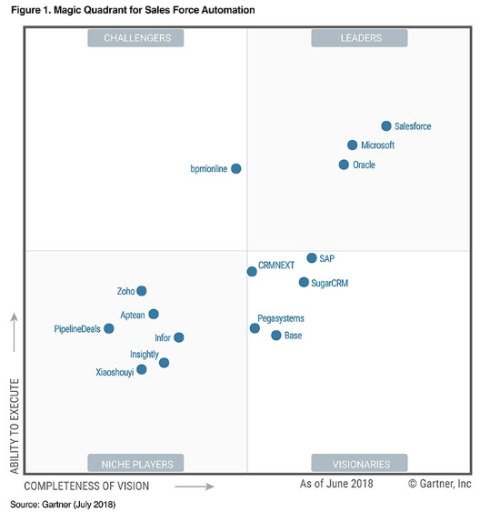

Salesforce is also named a Leader in the Gartner Magic Quadrant for the CRM Customer Engagement Center — for 10 Consecutive Years.

What it means in the world of analytics?

The market of data analytics and big data is big with a bright road ahead. International Data Corp. (IDC) expects worldwide revenue for big data and business analytics (BDA) solutions to reach $260 billion in 2022. It values the current market at $166 billion, up 11.7 per cent over 2017.

Coupled with it is the fact that established organisations are coveting to become a customer-centric organisation, hardwiring customer in every decision they make.

Customer analytics is at the heart of it, entwining snugly between them and offering organisations insights that can help reach their customer focus goals.

Amidst all this, it very much makes sense that a Customer relationship management leader ties knots with a world-class data discoverer and visualiser. Through this step, it not only plunges into the lucrative market of analytics but also secures itself for the future from other companies interested in the same fields.

At a high level, organizations are turning to Big Data and analytics solutions to navigate the convergence of their physical and digital worlds,” said Jessica Goepfert, program vice president for customer insights and analysis at IDC, in a statement.

Google, for example, picked up enterprise intelligence and analytics firm Looker for $2.6 billion last week in a bid to strengthen the tech giant’s smart analytics platform and Google Cloud’s digital transformation business. SAP’s purchase of Qualtrics for $8 billion in 2018 is another story. And there are many other.

What it means to its customers?

Many Salesforce customers already use Tableau. Both have a powerful business appeal.

Although a leader in many ways, what salesforce lacked was the virtue of customer analytics that its competitors had nailed better but this deal strengthens it in that area too.

Tableau has about 86,000 business customers, including Charles Schwab, Verizon (which owns TC), Schneider Electric, Southwest and Netflix. Tableau was being used mostly by Sales and Marketing departments. 70% of Tableau users use it for decentralised analytics ( as per Gartner research). This deal will help make increase Tableau’s business appeal.

The merger will help organisation to become more customer focused. We may expect better business alignments, implementation and purchase options. Tableau pricing and purchase has been its biggest negative point.

Salesforce said Tableau will operate independently and under its own brand post-acquisition. But as the acquisition stories go, in few years times the child gets absorbed into the parent brand. Further, the goals get aligned as per the demands and voice of the mother ship.

Tableau so far has been competing only in BI and analytics sphere. As an independent company it had the luxury to focus only on BI and analytics.

Tableau is a fantastic front end tool but its enterprise level implementation features (in terms of data preparation and transformation) were not competitive and hence it was pulling socks there.

Does this mean going forward it will no more work on that aspect?

Will it just remain a data discoverer and visualiser and no more aspire to become the well round BI solution like Microsoft’s Power BI, Oracle’s OBI, etc.?

I am keen to know what it means to you?

What’s going on in your mind?

How it changes your position as a business, provider or Tableau developer?